Incorrect invoice processing can jeopardize your business’s credibility and relationship with vendors and distributors. Manually checking and processing thousands of invoices without delay and discrepancies is a core challenge for manufacturers. Furthermore, the lengthy approvals needed to process invoices by concerned department heads can delay production and supplies and increase processing costs per invoice.

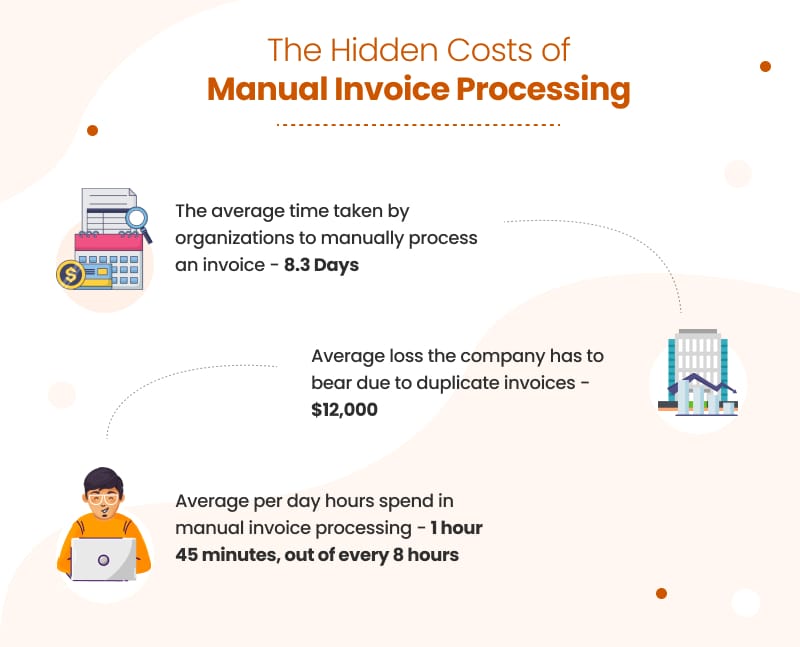

As per the Institute of Finance and Management (IOFM) report, only 24% of businesses that manually process their invoices (fewer than 20,000 annually) can pay purchase order-based invoices without delay. The median cost per invoice for such companies is $15.97, while for organizations using automated invoice processing solutions, it is $12.98.

The manual process involves several invoice processing challenges for the AP (accounts payable) department, impacting manufacturing efficiencies. This post brings to you major invoice processing challenges and possible ways of overcoming them with the help of technology and automation.

9 Common Manual Invoice Processing Issues Affecting Manufacturing Operations

Manually processing a large number of invoices is tedious, leading to payment errors and inefficiency in production and workflow. It can also raise security and legal challenges with suppliers and clients.

Here are some common challenges involved in manual invoice processing that needs to be addressed on a priority basis:

1. Irregular invoice payments can delay production and shipments

Processing thousands of invoices manually can lead to irregularities or delay. As a manufacturing unit, payments to suppliers must be processed on time to get raw materials, machinery, and other equipment. If invoices are not generated/processed on time, you won’t get supplies on time, eventually affecting the entire production and supply chain.

2. Discrepancies in invoices can lead to late payments and penalties

Human errors and inaccuracies are common & undeniable with manual processing. When generating or processing invoices, both the sender and receiver must have clear details about the invoice amount, payment method, quantities, rates, billing cycle, etc.

Human errors and inaccuracies are common & undeniable with manual processing. When generating or processing invoices, both the sender and receiver must have clear details about the invoice amount, payment method, quantities, rates, billing cycle, etc.

Discrepancies in any of these can delay the payments as the AP department will require more time to validate the details and resolve the errors. This can create confusion amongst your accounts departments and suppliers, affecting the entire workflow. At worst, in some scenarios, you have to pay financial penalties due to payment delays.

3. Delayed invoice payments affect relationship with suppliers

Not only human errors/discrepancies but also lengthy approval cycles can delay invoice processing and payments. In manual processing, the invoices keep traveling back and forth between various departments for approvals, delaying the process and shipment of goods.

Late payments ( if it occurs regularly) can frustrate the vendors or distributors and impact their cash flow. In the long term, it can affect your company’s credibility, financial terms, and relationship with suppliers.

Streamline and Accelerate Invoice Processing with Professional Support

4. Checking multiple data points manually across invoices can lead to inaccuracies

As a manufacturing unit, if you have a large vendor network, thousands of invoices come from them every year. While some are simple and easy to process, others can be complex, with multiple data points requiring multi-step validation. Missing out on any critical data point can create confusion among parties and affect the production timeline.

Another common issue with checking data points manually across multiple invoices is incorrect/missing items. Sometimes, the items mentioned on the purchase order by the vendor don’t align with the items you have received.

With manual processes, it can take some time to realize that certain items are missing or incorrect in the invoice provided by the supplier, leading to financial loss or delay in production.

5. Missing or duplicate invoices affect cash flow & credibility

Paper invoices can easily be misplaced/lost during manual approvals from one department to another. Sometimes, suppliers send you invoices more than once in case of payment delay or out of confusion.

The unpaid or duplicate payments can create friction between the AP department and vendors with subsequent recovery hassles. In both scenarios, your financial cash flow and supplier relationship get affected severely.

6. Increase in the cost spent per invoice as more time and resources are invested

Time is money in every business. Investing a large number of resources and time in manual invoicing for thousands of invoices every year eventually costs you a lot. Compared to the automated process, the manual approach always has more processing costs, which can vary for different vendors depending on the calculation factors.

With too much money spent on paper, valuable staff, and resources, the median cost per invoice for manual processing can be between $13-$40.

7. Lack of visibility and control over the production spending and workflow

Managing invoice processing manually doesn’t give the AP department much control and visibility over the spending insights. As they use paper and email systems to take approvals and manage invoices, data is unorganized and cluttered, with poor visibility for future references.

8. Non-compliance with financial agreements can cause security and legal challenges

Crucial data can be easily compromised during the manual processing of multiple invoices, leading to security and legal issues. To prevent fraud or loss of crucial information, storing data with the latest AES encryption is vital so only authorized people can access it.

9. Poor scalability with limited resources

As your supplier and customer base grows, invoice processing needs also increase. In such a scenario, keeping all your resources occupied in manually processing the invoices leaves less or no room for scalability.

You have to hire and train more staff for large invoice processing needs when relying on a manual approach, costing you more time and money. As a result, you will lose time on other crucial administrative and operational tasks.

How Can Automation Solve the Common Invoice Processing Challenges?

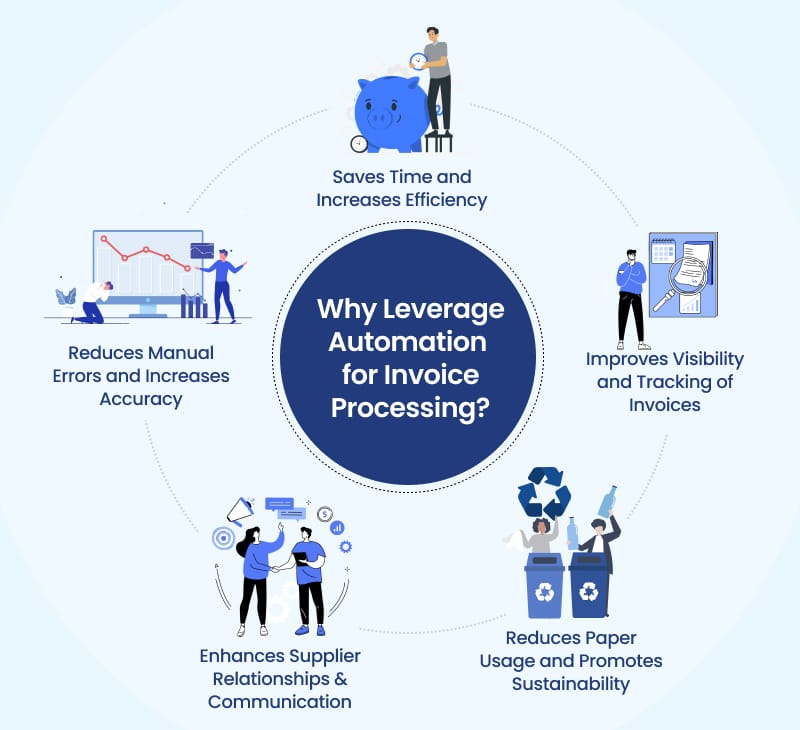

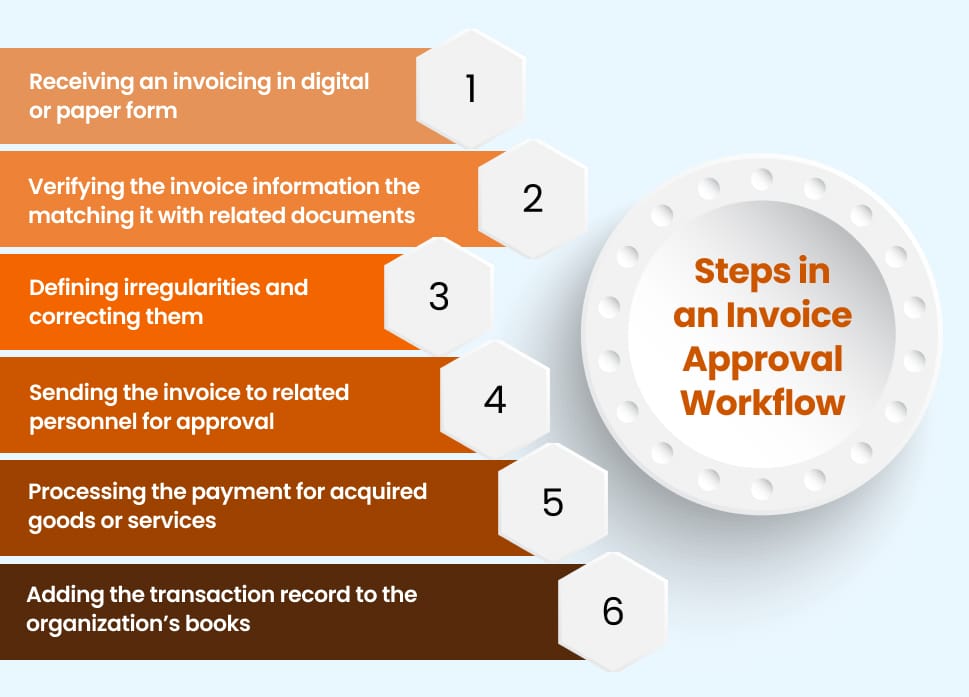

Digitalizing the invoicing process can save you a lot of time, effort, and resources. The automated tools and bots simplify the data extraction, storage, approval, and validation process to eliminate inaccuracies and discrepancies without spending hours on paper-based invoices.

Here is how automated invoice processing is effective as a solution to overcome manual invoice processing issues:

1. On-time payment

With automated workflows, you can streamline & accelerate the process of generating, checking, and approving invoices to pay on time. The smart workflow allows you to:

- Extract and maintain data from multiple sources into a structured format to quickly find discrepancies

- Reduce approval cycles by setting reminders and notifications for respective approvers and routing the invoices directly to the concerned department

- Categorize invoices based on priority, vendor type, payment due date, etc., to avoid late payments & penalties

- Automate time-consuming tasks like data entry and validation to reduce the cost spent per invoice

- Establish better communication and transparency between accounts departments and suppliers

- Validate data at multiple checkpoints like invoice receipts, expense reports, approvals, payment queries, billing cycles, etc., to process timely payments without any discrepancies

- Ensure uniformity between purchase orders, vendor invoices, and reports received through three-way matching to avoid duplicate/missing payments

- Maintain consistent cash flow through liquidity planning

2. Eliminate errors and inaccuracies to improve data quality

Using rule-based algorithms and bots, you can easily detect human or system-generated errors to fix them quickly. With the use of OpenText Intelligent Capture, manual errors can be detected & eliminated automatically to facilitate auditing.

To check for missing or incorrect items, automated tools can match the information in the final invoice with the purchase order. This way, you don’t have to spend hours verifying details with vendors through emails and calls.

3. Save time and resources

By digitizing your invoice processing requirements, you can shrink paper trails and other resources. Through electronic payment solutions, vendors can get eReceipts, and all the data will be digitalized to allow access anytime from anywhere. This way, data can be organized in a structured manner in one place without losing/misplacing any invoice.

As AI bots and tools will extract and validate data at multiple checkpoints, it eliminates the need for manual error checking and handling, saving much time.

4. Lower labor costs

To calculate labor costs or cost per invoice, you can simply multiply an employee’s hourly rate by the time spent on manual processing on one invoice. The high cost per invoice can be one significant indicator of the poor efficiency of your accounts payable department.

The time taken to review an invoice, find errors, and rectify them determines the labor costs in manual invoice processing

Through automated workflows and tools, you can reduce overall labor costs to save thousands of dollars annually. Instead of paying 4-5 people to do the job, you can save money by just paying 1 or 2 people to work on automated invoice processing tools for the entire process.

5. Accelerate the approval process

The automated workflows can expedite the invoice approval process in the following ways:

Automated Routing: When the details are verified at multiple checkpoints after entering the system, the signing authority doesn’t need to invest much time in it for review. By categorizing invoices based on priority and vendor type, they can be routed directly to the concerned department or person for quick approvals.

Notification Alerts/Reminders: You can choose a period to set reminders and notifications for all invoices to avoid delayed or missing payments. Approvers can also see the status of every invoice (approved or rejected) to eliminate processing delays.

Mobile Accessibility: Nowadays, automated tools allow you to access documents on your mobile devices to review/sign them anywhere (even when out of the office) to avoid unnecessary delays

6. Enhance productivity and efficiency

By automating the workflow, you can eliminate errors to improve the efficiency of the accounting department. As data is validated and rectified automatically, it saves plenty of time that can be utilized in other crucial accounting tasks for better productivity.

eInvoicing makes the process faster, more accurate, and hassle-free for both vendors and manufacturing units.

7. Strengthen relationships with suppliers

As approvals and payments are processed on time with less or no discrepancies and confusion, it improves your relationship with your suppliers. When vendors are happy with your on-time payment efforts, you can easily negotiate with them for better financial terms or discounted prices to gain a competitive advantage.

8. Minimize the risk of fraud and data breach

The automation feature enhances transparency and security while storing all the invoice data. As the data is centralized, the AP department has better visibility of payment records. They can easily track all the transaction histories, which payment is processed and made by which department, and when to avoid future conflicts.

Also, the data in such automated invoice processing software is encrypted through HTTPS or AES encryption to allow only authorized logins.

To further minimize the internal risk of fraud, the roles can be segregated for different employees so one person can handle invoice receiving while another can process payment.

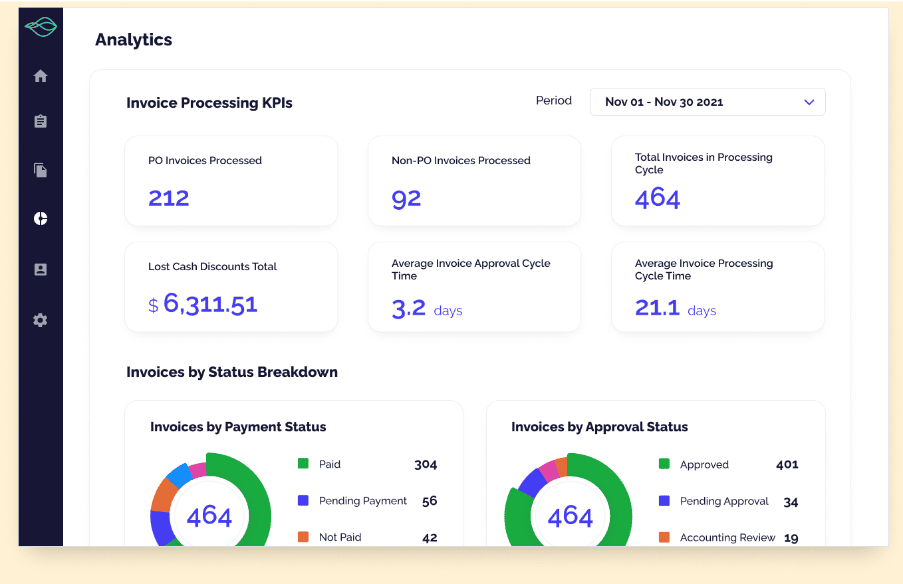

9. Gain detailed insights on invoice processing KPIs

For better visibility and detailed analysis, the analytical dashboard of automated invoice processing tools has graphical reports. You can filter reports through various key metrics to understand spending patterns in detail.

According to their needs, the AP department can configure the dashboard to perform the following functions:

- Track crucial metrics and KPIs like invoice processing time, error rate, invoices paid on time, total sales/expenses per day, unpaid invoices, pending approvals, etc., to check efficiency.

- Analyze the cash flow, daily/monthly expenses, and available liquidity to plan supply chain expansion and other operations.

- Get notifications about pending, missing, incorrect, and late payments to avoid penalties.

Final Verdict

Automation is the key to effective, accurate, and fast invoice processing needs for small and large manufacturing businesses. You cannot overcome challenges in invoice processing through a manual approach for large volumes, as it can lead to financial errors, delayed payments, confusion among suppliers, and a bad business reputation. While automated tools can simplify the invoice processing workflow, hiring in-house resources and training them to manage these tools can be tedious and expensive for businesses.

By outsourcing digital invoice processing services to a reliable company, you will get expert services from skilled professionals who are well-versed in the use of required invoice processing tools and technologies. This lets you save time and focus more on business growth and critical financial decisions.